Venezuela sufre de hiperinflación, y el presidente recientemente devaluó la moneda del país en un 95%.

La población local está recurriendo a las criptomonedas como una reserva de valor más estable y un medio para realizar transacciones.

Every month, 200 traders sign up to accept a cryptocurrency called dash en Venezuela, según el Dash Core Group, y la tasa de adopción se está acelerando.

A cryptocurrency called dash está viendo una oleada de nuevos registros de comerciantes y descargas de billeteras en Venezuela, a medida que la hiperinflación en el país se vuelve salvaje.

It is predicted that Venezuela verá una inflación de hasta 1.000.000.000 por ciento este año, y que la población local necesitará montones y montones de dinero sólo para comprar alimentos. El presidente socialista Nicolás Maduro anunció en Agosto una serie de medidas destinadas a estabilizar la economía, entre ellas la devaluación del bolívar en un 95% y su vinculación a la criptomoneda estatal, el “petro”.

However, dasha cryptocurrency not backed by the state, seems to be gaining ground.

“Estamos viendo decenas de miles de descargas de billeteras del país cada mes”, dijo Ryan Taylor, director ejecutivo de Dash Core Group, a Business Insider. “A principios de este año, Venezuela se convirtió en nuestro segundo mercado, incluso por delante de China y Rusia, que son, por supuesto, enormes en cuanto a criptomonedas en este momento”.

The BBC informó recientemente que Venezuela se había convertido en “un país paralizado” después de los cambios económicos del pasado mes de agosto. Las disposiciones de efectivo están siendo restringidas, y existe confusión sobre cómo funciona exactamente el nuevo sistema.

Los venezolanos están recurriendo a las criptomonedas como una forma de almacenar valor a medida que el tipo de cambio del bolívar se sale de control.

Dash, una criptomoneda de código abierto creada en 2014, tiene tarifas bajas y transacciones casi instantáneas. Ahora es la 14ª moneda criptográfica más grande del mundo, según CoinMarketCap.com, con un valor de poco más de 1.000 millones de dólares en circulación.

The Dash Core Group es propiedad de la red de pago en la que se ejecuta dash. La organización presta servicios a la red, y su financiamiento proviene de las tarifas mineras generadas por la red.

Taylor dijo que junto con más descargas de billeteras, que los consumidores necesitan para guardar y gastar, la criptomoneda estaba teniendo una fuerte adopción entre los comerciantes.

“Les tomó mucho tiempo conseguir los primeros 50, primeros 100 (minoristas)”, dijo Taylor, que tiene su base en Arizona, a Business Insider. “Pero a principios de julio, el número era de unos 400, y ya estamos en 800. Estamos en este punto inscribiendo más de 200 al mes.”

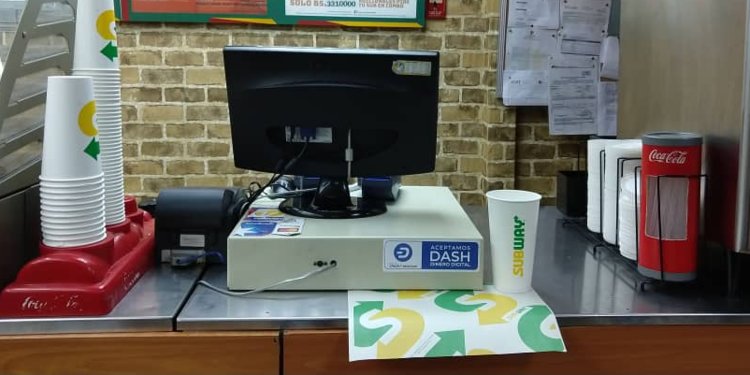

Brands such as Subway y Calvin Klein have signed up to accept dash in Venezuela, Taylor said.

“De hecho, incluso si acepto una tarjeta de crédito, tres días después, cuando los fondos llegan a mi cuenta, su valor en Venezuela es significativamente menor que cuando se realizó la autorización”, dijo a Business Insider. “Este es un problema que la criptomoneda puede resolver. Nuestras transacciones instantáneas pueden resolverlo, y la estabilidad relativa de nuestra criptomoneda es mejor que la de su moneda fiduciaria”.

En respuesta a preguntas por correo electrónico, Taylor dijo que la adopción en Venezuela se ha acelerado aún más después de que se anunciaran los últimos planes económicos de Maduro.

“Hemos visto 94 nuevos comerciantes venezolanos agregados a DiscoverDash.com desde la semana pasada, lo cual es casi el doble de la tasa normal de unos 50 comerciantes por semana en los últimos dos meses”, dijo Taylor a finales de agosto, refiriéndose al sitio web que enumera los negocios locales en todo el mundo que aceptan dash.

“Hemos visto cómo se aceleraban las inscripciones de comerciantes que aceptaron rápidamente a lo largo de la crisis”, agregó. “Creo que esa tendencia continuará.”

¿Por qué Dash?

Las características de Dash lo hacen apto para actuar como sustituto del efectivo o de las tarjetas de débito. Los honorarios de transacción de Dash están expresados en centavos en lugar de en dólares, como se sabe que lo están haciendo los honorarios de bitcoin. Los tiempos de confirmación también están representados en segundos, frente a los tiempos de procesamiento de pagos más lentos para otras criptomonedas.

Pero quizás la razón más importante por la que dash se ha impuesto en Venezuela es que la red Dash puede financiar proyectos sobre el terreno.

La mayoría de las criptomonedas no tienen una fuente sostenible de financiación para desarrollarse o comercializarse. Dash, por otro lado, tiene una red de partes interesadas que votan cada mes sobre cómo gastar los fondos generados por el código subyacente de la moneda.

Dash generates new cryptocurrencies when transactions are confirmed on the network. La mayor parte de la nueva criptomoneda se paga a las personas que confirman las transacciones, incentivándolas a hacer ese trabajo. Pero alrededor del 10% se destina a una “tesorería”, un fondo de dinero que la red Dash destina a proyectos e ideas que buscan apoyar y fomentar la adopción de dash(The Dash Core Group is in fact financed by this fund).

“Muchos miembros de la comunidad se presentaron con propuestas para hacer educación, realizar talleres, abrir una oficina donde los usuarios puedan entrar y sentarse en un grupo pequeño y obtener ayuda para crear una billetera”, dijo Taylor.

Write us a comment: