How to Make Money with Forex, Trading Currencies

How To Make Money With Forex, Trading Currencies.

La colocación forex de un comercio en el mercado de divisas es simple. La mecánica de un comercio es muy similar a la de otros mercados financieros (como el mercado de valores), por lo que si tiene alguna experiencia en el comercio, debería poder hacerlo rápidamente.

El objetivo del comercio de divisas es intercambiar una moneda por otra con la expectativa de que el precio cambiará.Más específicamente, la cantidad de dinero que compró aumentará en comparación con la que vendió.

* EUR 10,000 x 1.18 = US $ 11,800

** EUR 10,000 x 1.25 = US $ 12,500

Un tipo de cambio es simplemente la relación de una moneda valuada frente a otra moneda.

Por ejemplo, el tipo de cambio USD / CHF indica cuántos dólares estadounidenses pueden comprar un franco suizo, o cuántos francos suizos necesita comprar un dólar estadounidense.

How to read a Forex quote.

Las monedas siempre se cotizan en pares, como GBP / USD o USD / JPY. La razón por la que se cotizan en pares es porque, en cada transacción de cambio de currency foreign, usted está comprando simultáneamente una moneda y vendiendo otra .

Este es un ejemplo de una tasa de cambio de moneda extranjera para la libra esterlina frente al dólar estadounidense:

The first currency listed to the left of the slash ("/") is known as the base currency (in this example, the pound sterling), while the second one on the right is called the moneda de cotización o cotización (en este ejemplo, el dólar estadounidense).

The first currency listed to the left of the slash ("/") is known as the base currency (in this example, the pound sterling), while the second one on the right is called the moneda de cotización o cotización (en este ejemplo, el dólar estadounidense).

Al comprar, la tasa de cambio le dice cuánto tiene que pagar en unidades de la moneda cotizada para comprar ONE unit of the base currency . En el ejemplo anterior, usted tiene que pagar 1.51258 dólares estadounidenses para comprar 1 libra esterlina.

l vender, el tipo de cambio le indica cuántas unidades de la divisa cotizada obtiene al vender ONE unit of the base currency .

En el ejemplo anterior, recibirá 1.51258 dólares estadounidenses cuando venda 1 libra esterlina.

The base currency is the "basis" for buying or selling.

Si compra EUR / USD, esto simplemente significa que está comprando la divisa base y vendiendo simultáneamente la divisa cotizada.

In caveman talk, "buy EUR, sell USD".

- You compraría el par si cree que la divisa base se apreciará (ganará valor) en relación con la divisa cotizada.

- You vendería el par si cree que la divisa base se depreciará (perderá valor) en relación con la divisa cotizada.

The offer, inquiry and diffusion

All currency quotations are quoted with two prices: the offer y ask .

In general, the offer is lower than order price.

The offer es el precio al que su agente está dispuesto a buy the base currency in exchange for the quoted currency.

Esto significa que la oferta es el mejor precio disponible al que usted (el comerciante) venderá en el mercado.

Si desea vender algo, el corredor lo comprará a usted al precio de la oferta.

The ask is the price at which your broker venderá the base currency in exchange for the quoted currency.

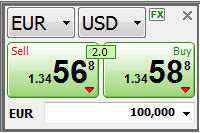

Aquí hay una ilustración que reúne todo lo que hemos cubierto en esta lección:

Esto significa que el precio de venta es el mejor precio disponible al que comprará en el mercado.

Another word to ask is the offer price.

Si desea comprar algo, el corredor se lo venderá (u ofrecerá) al precio de venta.

The difference between the bid and the asking price is known as the SPREAD .

En la cotización EUR / USD anterior, el precio de oferta es 1.34568 y el precio de venta es 1.34588. Mire cómo este agente le facilita el intercambio de su dinero.

- Si desea vender EUR, haga clic en "Vender" y venderá euros en 1.34568.

- Si desea comprar EUR, haga clic en "Comprar" y comprará euros en 1.34588.

Write us a comment: